Just landed in the US or UK without an SSN, and feeling stuck with no way to build credit or rent a flat? Turns out, you actually can get a credit card—no SSN needed. Let’s break it down.

What you will discover in this guide:

-

Yes, you can get a credit card in the US & UK without an SSN.

-

Which 10 cards are truly ideal for international students?

-

How to apply with alternatives like ITIN, passport, or as an authorized user.

-

Tips to build your credit history from day one.

Can You Get a Credit Card Without an SSN?

In the USA

-

Absolutely. Many issuers accept alternatives like:

-

ITIN (Individual Taxpayer Identification Number) instead of SSN.

-

Passport, visa, offer letters, I‑20, pay slips, or school ID.

-

-

Other routes:

-

Become an authorized user on someone else’s account.

-

Get a secured credit card by depositing money upfront.

-

In the UK

-

The credit system works differently, and lenders don’t require an SSN—they look at your Visa status, UK bank account, utility bills, and rental history.

-

Student credit cards or guarantor agreements are common routes.

10 Best Credit Cards for International Students (No SSN Needed)

These cards are tailored for newcomers to the U.S. who might not yet have an SSN. Each listing includes a card overview, benefits, drawbacks, and a “how to apply” guide.

1. Zolve Credit Card (Classic / Signature / Black)

Overview:

Zolve is a fintech company designed specifically for immigrants and international students. You can apply before arriving in the U.S., using only your passport and visa.

Advantages:

-

No SSN or ITIN required.

-

Up to 3% cashback (depending on the card type).

-

No annual fees, no foreign transaction fees.

-

Offers international insurance, lounge access (for premium cards), and a checking account.

-

Reports to all three credit bureaus (Experian, Equifax, TransUnion).

Read Also: 7 Best Budgeting Apps for College Students

Limitations:

-

Credit limits may start lower than U.S.-born students with a history.

-

Not as widely accepted in person as traditional banks (depending on the merchant).

How to Get It:

-

Visit zolve.com and apply using your passport, visa (F1/J1), and school admission letter.

-

Can be approved while you’re still overseas.

2. Deserve EDU Mastercard

Overview:

Built for international students, Deserve EDU doesn’t require an SSN and offers a solid rewards program.

Advantages:

-

1% unlimited cashback on all purchases.

-

Free Amazon Prime Student for one year (worth ~$69).

-

No annual fee or foreign transaction fees.

-

Reports to all major credit bureaus.

Limitations:

-

No balance transfer or cash advance.

-

Lower credit limits (~$500–$1500 initially).

-

Must be actively enrolled in a U.S. college or university.

How to Get It:

-

Apply online at deserve.com.

-

Submit passport, visa, school ID, and U.S. address. No credit history needed.

3. Firstcard Credit Builder

Overview:

A newcomer-friendly secured credit card with generous cashback rewards and no interest charges.

Advantages:

-

No credit check or SSN needed.

-

Up to 15% cashback with select merchants.

-

No interest (0% APR), no late fees, and no annual fees.

-

Build credit easily with a small security deposit.

Limitations:

-

Must connect to a U.S. bank account.

-

Requires a small deposit ($50–$200).

-

Cashback is limited to partner merchants.

How to Get It:

-

Sign up on the Firstcard app.

-

Provide a passport, proof of school enrollment, and a U.S. checking account.

4. Petal® 2 “Cash Back, No Fees” Visa Card

Overview:

This innovative card evaluates your cash flow (bank history) instead of your credit score—ideal for international students with steady bank deposits.

Advantages:

-

1–1.5% cashback on all purchases.

-

No annual fee, no late fees, no foreign transaction fees.

-

Reports to major bureaus.

Limitations:

-

May need an ITIN or a U.S. bank account.

-

No balance transfer or cash advance features.

How to Get It:

-

Apply at petalcard.com using the “new to credit” option.

-

You can link your U.S. bank account instead of submitting a credit score.

5. Capital One Quicksilver Student Cash Rewards

Overview:

One of the best starter cards from a mainstream bank, and friendly toward international students with an ITIN.

Advantages:

-

1.5% cashback on all purchases.

-

No annual fee or foreign transaction fees.

-

Strong customer support and mobile app.

Limitations:

-

Must have a U.S. credit file or ITIN.

-

May require a U.S. bank account.

How to Get It:

-

Apply on capitalone.com.

-

Use an ITIN instead of an SSN. Submit your passport, visa, and proof of school enrollment if requested.

6. Capital One SavorOne Student Cash Rewards

Overview:

A rewards-packed version of the Quicksilver is designed for students who spend more on dining and entertainment.

Advantages:

-

3% cashback on dining, grocery stores, streaming, and entertainment.

-

1% on all other purchases.

-

No annual or foreign transaction fees.

Limitations:

-

Requires ITIN.

-

Higher approval threshold than basic student cards.

How to Get It:

-

Apply online with an ITIN, U.S. address, and proof of enrollment.

-

May be required to open a Capital One bank account.

7. Capital One Journey Student Rewards

Overview:

Perfect for students who want to be rewarded for paying bills on time.

Advantages:

-

1% cashback on all purchases; bumped to 1.25% with on-time payment.

-

No annual fee, and no foreign transaction fee.

-

Builds credit over time with timely use.

Limitations:

-

Requires ITIN.

-

Basic rewards program compared to SavorOne.

How to Get It:

-

Apply at Capital One’s website.

-

Enter your ITIN where SSN is requested.

8. Chase Freedom® Student Credit Card

Overview:

A Chase-branded student credit card with straightforward rewards and a loyalty bonus for good behavior.

Advantages:

-

1% cashback on every purchase.

-

$50 sign-up bonus after first purchase.

-

$20 annual reward for five years with on-time payments.

Limitations:

-

3% foreign transaction fee (not travel-friendly).

-

Requires ITIN and possibly a Chase account.

How to Get It:

-

Apply online or visit a Chase branch.

-

Use ITIN, provide proof of student status, and a U.S. address.

9. Bank of America® Customized Cash Rewards for Students

Overview:

Offers tailored cashback categories—ideal for students who want control over rewards.

Advantages:

-

3% cashback on a category of your choice (gas, online shopping, dining, etc.).

-

2% at grocery stores, 1% on other purchases.

-

No annual fee.

Limitations:

-

Charges foreign transaction fees (~3%).

-

Requires a U.S. bank account and likely an ITIN.

How to Get It:

-

Visit a Bank of America branch with a passport and a student visa.

-

An online application is available if you already have an ITIN.

10. Citi® Secured Mastercard® / Simplicity®

Overview:

Citi offers a few secured options that accept ITINs and are ideal for those just starting.

Advantages:

-

No annual fee.

-

Reports to all three credit bureaus.

-

Graduates to unsecured cards after 12+ months of good use.

Limitations:

-

Requires a security deposit (usually $200+).

-

No cashback or perks.

How to Get It:

-

Apply at citi.com with ITIN, U.S. address, and security deposit.

-

Can also apply in-branch if near a Citi office.

Read Also: 10 Free Software and Apps for University Students

UK Options: No SSN Required

-

UK Student Credit Cards: Issuers like Santander, Barclaycard, and Natwest offer student cards with minimal credit history.

-

Guarantor Cards: e.g., Aqua Classic, where a UK resident co-signs.

-

Mobile-based cards: Apps like Revolut, Monzo, and Starling offer credit lines after UK account set-up and a few months of activity.

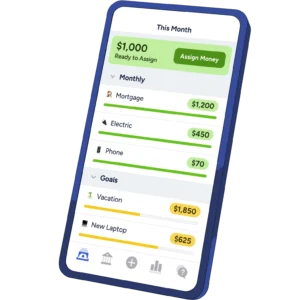

Compare Highlights Table

| Card | Requires SSN? | Alt ID | Rewards | Annual Fee | Foreign Fee | Reports to Bureaus |

|---|---|---|---|---|---|---|

| Zolve | ❌ | Passport | 1–3%+ | $0 | ❌ | All 3 |

| Deserve EDU Mastercard | ❌ | Passport | 1% | $0 | ❌ | Major 3 |

| Firstcard Secured | ❌ | Passport/ITIN | 1–15% | $0 | ❌ | Major 3 |

| Petal 2 Visa | ❌ | ITIN | 1–1.5% | $0 | ❌ | Major 3 |

| Cap One Quicksilver Student | ❌ | ITIN | 1.5% | $0 | ❌ | Major 3 |

| Cap One SavorOne Student | ❌ | ITIN | 3% categories | $0 | ❌ | Major 3 |

| Cap One Journey Student | ❌ | ITIN | 1% + on-time bonus | $0 | ❌ | Major 3 |

| Chase Freedom Student | ❌ | ITIN | 1% + bonus | $0 | ✅ 3% | Major 3 |

| BofA Cash Rewards Student | ❌ | ITIN | 3/2/1% structure | $0 | ✅ maybe | Major 3 |

| Citi Simplicity | ❌ | ITIN | – | $0 | ✅ 3% | Major 3 |

Tips To Get Approved

-

Apply with ITIN first—essential for the US.

-

Use a passport, an I‑20, proof of enrollment, bank statements, and address proof.

-

Consider secured cards—easier approval.

-

Become an authorized user—build a score quickly.

-

Build credit history:

-

Pay on time

-

Keep utilization <30%

-

Monitor via Experian, TransUnion, Equifax

-

Add rent/utilities via Experian Boost

-

For UK Students: Build Credit History

-

Pay bills before the due date.

-

Register on the Electoral Roll once eligible.

-

Maintain a stable address and phone number.

-

Use a guarantor or student cards to start.

Frequently Asked Questions

Do these cards affect my visa status?

No—having a credit card demonstrates financial responsibility and is generally seen positively by immigration, but always use it wisely.

Can I upgrade later to an unsecured card?

Yes—most issuers offer graduation paths after 6–12 months of responsible use.

Will UK credit info help US credit?

Unfortunately, no. That’s why US cards and ITINs don’t transfer. For cross-border credit-building, consider services like Nova Credit.

In summary

Yes, Credit Cards for International Students without a Social Security Number are abundant in the USA—options like Zolve, Deserve, Firstcard, Petal, Capital One, Chase, BofA, and Citi. In the UK, student cards and guarantor systems are your starting point.

Next steps:

-

Choose your top pick (secured vs. unsecured, rewards vs. simplicity).

-

Gather ID: Passport, visa/ITIN, enrollment proof, and bank statements.

-

Apply—online or in branch.

-

Use it responsibly—on time, wisely, and refresh regularly.

You are not stuck without an SSN. With the right credit card, you’ll build financial freedom—rent that flat, order essentials, and enjoy flexibility during your studies.