You don’t need to be rich to stay in school—you just need a game plan.”

College is exciting. It’s your first taste of freedom, your chance to explore new ideas, meet new people, and prepare for your future career. But let’s be real: it’s also expensive. Between tuition, textbooks, rent, food, and social life, costs add up quickly. If you’ve ever found yourself googling how to save money as a college student, you’re not alone. Whether you’re studying in the USA or the UK, managing money in college is one of the biggest challenges you’ll face, but also one of the most important skills you’ll develop.

This practical, down-to-earth guide will help you take control of your finances without sacrificing the college experience. From everyday money hacks to smarter ways of budgeting, you’ll learn strategies that work for real students living on real budgets.

Understand Your Financial Landscape

Know Where Your Money Goes

Before you can save money, you need to understand where it’s going. Track your spending for at least a month. Use budgeting apps like Mint (USA), Emma or Monzo (UK), or a simple Google Sheet.

Tips:

- Categorize every expense (food, transport, housing, entertainment).

- Identify spending habits that drain your wallet.

- Spot subscriptions you’re not even using.

Budget Like a Boss

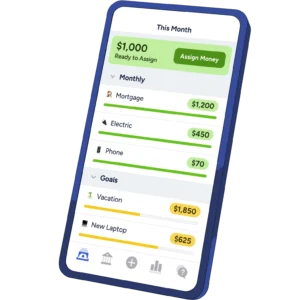

A budget isn’t a punishment—it’s a plan. Set monthly limits based on your income and expenses.

Budgeting Methods That Work:

- 50/30/20 Rule: 50% needs, 30% wants, 20% savings/debt.

- Zero-Based Budgeting: Every dollar or pound is assigned a job.

Tools: YNAB (You Need a Budget), Goodbudget, or Excel spreadsheets.

Read Also: 10 Free Software and Apps for University Students

Master Student Discounts

Use Your Student ID Like a VIP Pass

Your student ID is a money-saving goldmine. Always ask, “Do you offer a student discount?”

USA Student Discount Hotspots:

- Apple and Microsoft tech discounts

- Amazon Prime Student

- Spotify + Hulu Bundle

- Greyhound and Amtrak fares

UK Student Discount Favorites:

- UNiDAYS and Student Beans apps

- 16-25 Railcard

- TOTUM card

- Boots Advantage Card Student Perks

Don’t Overlook Local Deals

Smaller, local businesses often give student discounts not advertised online. From barbershops to yoga studios, it’s always worth asking.

Cut Down on Living Expenses

Save on Housing

Housing is one of the largest college expenses.

Tips:

- Consider living off-campus with roommates.

- Choose smaller towns or suburbs with lower rent.

- Apply to be a Resident Assistant (RA) for free/discounted housing.

Lower Your Utility Bills

- Turn off lights and electronics when not in use.

- Share Wi-Fi with roommates.

- Use energy-saving bulbs and unplug devices.

Meal Planning is a Superpower

Food spending can sneak up on you fast.

Smart Strategies:

- Meal prep for the week ahead.

- Use apps like Too Good To Go (UK), Flashfood (USA), or local food banks.

- Cook with friends to share costs.

Textbook & Tech Tricks

Avoid Paying Full Price for Textbooks

- Buy used or rent books (Amazon, Chegg, AbeBooks).

- Use library reserves and online PDFs.

- Join book swap groups on Facebook.

Save on Tech

- Use your student email to get discounts on Adobe, Microsoft, etc.

- Buy refurbished laptops and tablets.

- Check university tech programs or grants.

Make Extra Cash on the Side

Flexible Side Hustles

- Freelance writing, tutoring, or graphic design

- Delivery driving (Uber Eats, Deliveroo)

- Virtual assistant gigs or online surveys

Campus Jobs

- Library assistant, tour guide, or research assistant

- Often offer flexible hours and decent pay

Sell What You Don’t Use

- Declutter and sell clothes, electronics, and books

- Use Depop, Vinted, eBay, or Facebook Marketplace

Read Also: Top 12-Month Student Broadband Deals in the USA and UK 2025

Travel Smarter

Save on Transportation

USA:

- Use student discounts on buses and trains

- Bike or use ride-share apps with referral bonuses

UK:

- Get a 16-25 Railcard for 1/3 off train fares

- Use Megabus or National Express for cheap long-distance travel

Avoid Parking & Petrol Costs

- Share rides with classmates

- Walk or cycle when possible

Entertainment on a Budget

Find Free and Cheap Fun

- University clubs and societies often host free events

- Check out museums, local festivals, and open mic nights

Stream Smartly

- Share subscriptions with friends/family

- Use student bundles (e.g., Spotify + Hulu, Apple One)

Smart Money Habits That Last

Automate Your Savings

- Set up a recurring transfer, even if it’s just $10/£10 a month

- Use apps like Acorns (USA) or Plum (UK) to save spare change

Build an Emergency Fund

Start with small goals: $100/£100, then build up. It cushions unexpected expenses without relying on credit cards.

Credit Cards: Use Them Wisely

- Choose student cards with low interest and rewards

- Pay your balance in full every month to avoid debt

Financial Aid and Scholarships

Apply for Everything

- Use platforms like Fastweb (USA) or Scholarship Hub (UK)

- Many small scholarships go unclaimed due to a lack of applicants

Know What You’re Entitled To

- Check eligibility for government grants and bursaries

- Consult your university’s financial aid office regularly

Conclusion: Mastering the College Money Game

Saving money as a college student isn’t about deprivation—it’s about direction. By making small, smart choices every day, you build habits that will pay off for the rest of your life. Whether you’re hustling a side gig, cooking your own meals, or squeezing every ounce of value from your student ID, you’re not just surviving college—you’re mastering it.

So take the first step today. Create your budget. Cancel that unused subscription. Apply for one more scholarship. Future you will thank you.