Imagine this: you go to your bank account or app one morning and see that, without hardly noticing, you’ve set aside hundreds of dollars (or pounds) more than you thought possible—and you didn’t even feel deprived. That’s the power of the sneakiest way to save money that actually works.

What is the sneakiest way you save money that actually works?

It’s this: automate your savings behind the scenes and make them invisible to your day-to-day spending radar. In short: you set it up once, forget about it, and your savings grow on autopilot.

For folks living in the USA or the UK—where cost-of-living pressures, bills, subscriptions and impulse spends all tug at your wallet—this method is especially effective. Let’s dig into why it works, how to set it up, and how to supercharge it.

Why this sneaky strategy beats many others

1. It sidesteps your “willpower tax”

We all have a finite amount of willpower each day: resisting that coffee, that impulsive online purchase, that “just one more takeaway”. By automating savings, you bypass the need to consciously decide each time. Instead, the decision is made once when you set it up, and thereafter your brain doesn’t have to contend with the “should I save or spend?” moment every time.

2. “Out of sight, out of mind” works in your favour

When money comes into your account and stays there without you consciously touching it, you hardly feel the loss. But that little chunk of money is still saved—it’s just invisible. Over time, invisible savings add up. Conversely, if you’re always mentally deciding “Do I save or do I spend this £50/$50?”, you might spend it.

3. Consistency builds momentum

Savings is less about one dramatic act than many small consistent ones. According to the experts at NerdWallet, tracking spending, setting goals and automating transfers are key steps. When you automate, you create consistency without constantly thinking about it.

4. It works in both the USA and UK context

Whether you earn in dollars or pounds, face US credit card bills or UK utility rises, the principle is universal. The mechanics may differ slightly (bank systems, tax-treatment, interest rates) but the core idea—automate and hide your savings—applies. For example, the UK’s MoneyHelper advises setting aside money and working with what’s left after essentials.

How to set up your automated stealth-savings system

Here’s a practical, step-by-step guide you can follow whether you’re in the US or UK.

Step 1: Review your income and outgoings

Spend a weekend reviewing your recent bank and card statements. What is coming in, what’s going out (rent/mortgage, utilities, food, transport, subscriptions, fun money). In the UK context, budgeting experts at UK Personal Finance recommend knowing realistically what you have to work with.

Step 2: Choose a “safe” amount to divert

Decide on a dollar or pound amount (or percentage) that you feel comfortable automating. It doesn’t have to be massive—perhaps £50/$50 or 5-10 % of your income to start. The key is: you feel like you can live with the adjusted spend-able amount.

Step 3: Automate the transfer

Set up a recurring transfer:

-

If you’re in the USA: From your checking account to a savings account (or high-yield savings, or even money market).

-

If you’re in the UK: From your current account to a savings account (or ISA if applicable).

Schedule it for immediately upon payday (or the day after). That way the moment money lands, a chunk is shifted out before you spend it.

NerdWallet advises automation as a major lever.

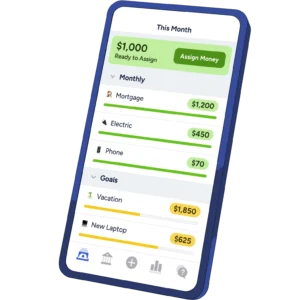

Step 4: Make the savings “invisible”

The trick is: your monthly (or weekly) budget is built after the savings transfer. So you only ever see the “left-over” balance for spending. You don’t feel the “lost” savings because you never budget it as spendable in the first place. Think of the money as “already spent towards your future.”

Step 5: Choose where your savings “live”

-

Ideal: an account you don’t use for everyday spending (so you’re less tempted to dip into it).

-

Bonus: use an account that gives a decent interest rate (or in the UK, an ISA that’s tax-efficient).

-

Don’t tie it up so you can’t access it if needed (unless you’re comfortable with that). Having an emergency fund is still smart.

Step 6: Monitor quarterly and adjust

Every three months or so:

-

Check if the amount you’re saving feels right (not too painful, not too trivial).

-

Check if you can increase it slightly (as income rises or spending falls).

-

Adjust your budget if your circumstances change (new job, move, etc.).

This is good practice recommended by both US and UK advice websites.

Putting the “sneaky” spin on it: extra tips to make it stealthy and sustainable

Here are ways to level up the sneaky side—so you hardly notice you’re doing it, but you feel the benefits later.

Trick A: Treat it like a “bill”

Right after payday, transfer your savings amount as if you’re paying a monthly bill (“Savings Bill”). When you think of it as a fixed outgoing, you accept it as part of your baseline expenses, rather than “optional”.

Trick B: Round up purchases and save the spare change

Many banks/apps offer “round-up” features: when you spend £3.62, it’ll round up to £4 and deposit £0.38 into savings. Over time, it adds up without you feeling it. This is especially useful in the US where many fintech apps support this feature.

Read Also: Best Temperature to Set the Thermostat in Winter to Save Money

Trick C: Use “micro-savings” for fun

Pick a trigger you do regularly (in the US maybe each time you buy lunch, each time you buy coffee; in the UK perhaps each time you go for a takeaway) and commit that you also put a small amount into savings each time. Because the amount is small you’re hardly conscious of it—but you build up habit.

Trick D: Automate “pay raises” for savings

If you get a raise, bonus or side-income, program your savings transfer to increase by a portion of that extra income (for example: delay spending the raise, instead allocate 50 % of it into savings). That way your lifestyle doesn’t inflate with every income lift, but your savings grow.

Trick E: Hide the account visually

If your banking app lets you rename accounts, hide the savings account behind a label like “Rainy Day Fund” or “Freedom Pot”. Out of sight = out of mind for spending. Your brain doesn’t treat it as “spendable”.

Trick F: Automate small frequent transfers if you can’t afford a big one

If large transfers would hurt your cash flow, set up multiple smaller transfers (e.g., every week) rather than one big monthly one. Still automatic and invisible, but gentler on your account.

Real-life scenarios for USA and UK residents

Example for a US reader

Jane gets paid bi-weekly and takes home ~$3,000 after taxes. She sets up an automatic transfer of $150 to her savings the day her paycheck lands. She renames the savings account “Future Me – Travel” and sets the bank app notifications off for that account (so she can check the balance monthly). Because she never sees the $150 in her checking account, her daily spending adjusts automatically. Over a year she saves ~$3,900.

She adds a bonus: each time she buys a coffee for $4 or more, she has a rule to also transfer $1 to savings. That adds another ~$50-$60 a year.

Example for a UK reader

Tom earns £2,800 net monthly. He opens a separate savings account and sets up a standing order for £100 immediately after payday. He labels the account “Holiday Fund.” Because his monthly budget is built after that £100 is excluded, he adjusts his remaining budget accordingly.

Once the salary increment kicks in, he increases the standing order to £120. He also uses a “round-up” feature via his current account: each time he swipes his debit card, the spare change goes into the Holiday Fund. Over three years he has built up enough for a decent holiday later—and he barely felt the transfer.

What to watch out for (and how to stay on track)

Pitfall 1: Transferring too much too early

If you set your automated savings so high that your remaining spendable income is too tight, you’ll feel deprived and may revert. Start comfortable, then scale.

Pitfall 2: Spending “sneakily” from the savings account

If your savings account is easy to access and you habitually dip into it, you lose the benefit of invisibility. Consider making the account slightly less convenient (e.g., different bank, or no debit card attached).

Pitfall 3: Not adjusting when life changes

If your salary falls, or your spending dramatically increases (e.g., child, relocation), you’ll need to revisit your plan. The strategy works best when it’s aligned with reality.

Read Also: Do Tankless Water Heaters Save Money?

Pitfall 4: Overlooking inflation/interest rates

In both the UK and USA, savings interest can be low. The goal of this strategy is behavioural rather than about chasing high returns. But it’s wise to keep your savings in an account that gives you something above zero if possible.

Pitfall 5: Ignoring other financial priorities

Automating savings doesn’t mean you should ignore debt or emergency funds. The advice from MoneyHelper in the UK emphasises building an emergency fund and covering essentials first.

Why this matters more now than ever

-

With inflation rising (in both US & UK markets), your traditional spending gets squeezed. Automated stealth savings means you keep moving ahead even while life costs escalate.

-

With subscription creep in both regions (streaming, apps, memberships), invisible savings help ensure these don’t eat into your future.

-

The “set-and-forget” nature aligns well with busy lives—parents, workers, side-hustlers—who don’t have time to micromanage every penny.

Sizing up the impact

Let’s do simple math for both markets:

-

USA: $150/month → $1,800/year → over 5 years that’s $9,000 (before interest)

-

UK: £100/month → £1,200/year → over 5 years that’s £6,000 (before interest)

And that’s just from modest automated transfers. Add round-ups, bonus income increases, side-income splits, and you could easily double that. It’s not about one huge leap—it’s about many small stealth steps adding up.

Tailor it to your personality

-

If you want extreme invisibility: “Set-it and forget-it.” Automate and don’t check the account too often.

-

If you’re motivated by visuals: check the account monthly and watch the balance climb—this reinforces the habit.

-

If you are a saver who still wants fun: build in a “fun fund” that’s automated too (say £20/$20 every month) so you don’t feel deprived.

-

If you get bonuses or irregular income: pret-set rules for “when bonus arrives, 50 % goes to savings”.

Conclusion: The one move you will be glad you made

There it is: the sneakiest way you save money that actually works is automate your savings so you never see it, so you never spend it, and yet it quietly grows. For people in the USA and UK, this method is simple, effective, and fits into busy lives without requiring extreme frugality or willpower marathons.

Recap key points:

-

Make savings automatic immediately after income arrives.

-

Treat it like a non-negotiable “bill”.

-

Keep the savings account separate and out of your regular spending view.

-

Start small, adjust over time, and build consistency.

-

Supplement with micro-savings and raise it when your income rises.

-

Monitor periodically—not daily—and adjust for life changes.

Trigger for action:

Tonight, pause your scrolling for five minutes. Open your banking app and schedule your first automatic savings transfer. Pick a comfortable amount. Label the account something that inspires you (“Freedom Fund”, “Rainy Day”, “Dream Trip”). Then forget about it—let the system do the work while you live your life.

By next month, you’ll already feel the difference: slightly more comfortable, slightly more in control. Six months from now, you’ll see the fruits of “invisible” savings. One year from now—you’ll be glad you started.